PharosFolio - Free ETF Portfolio Simulator for European Investors

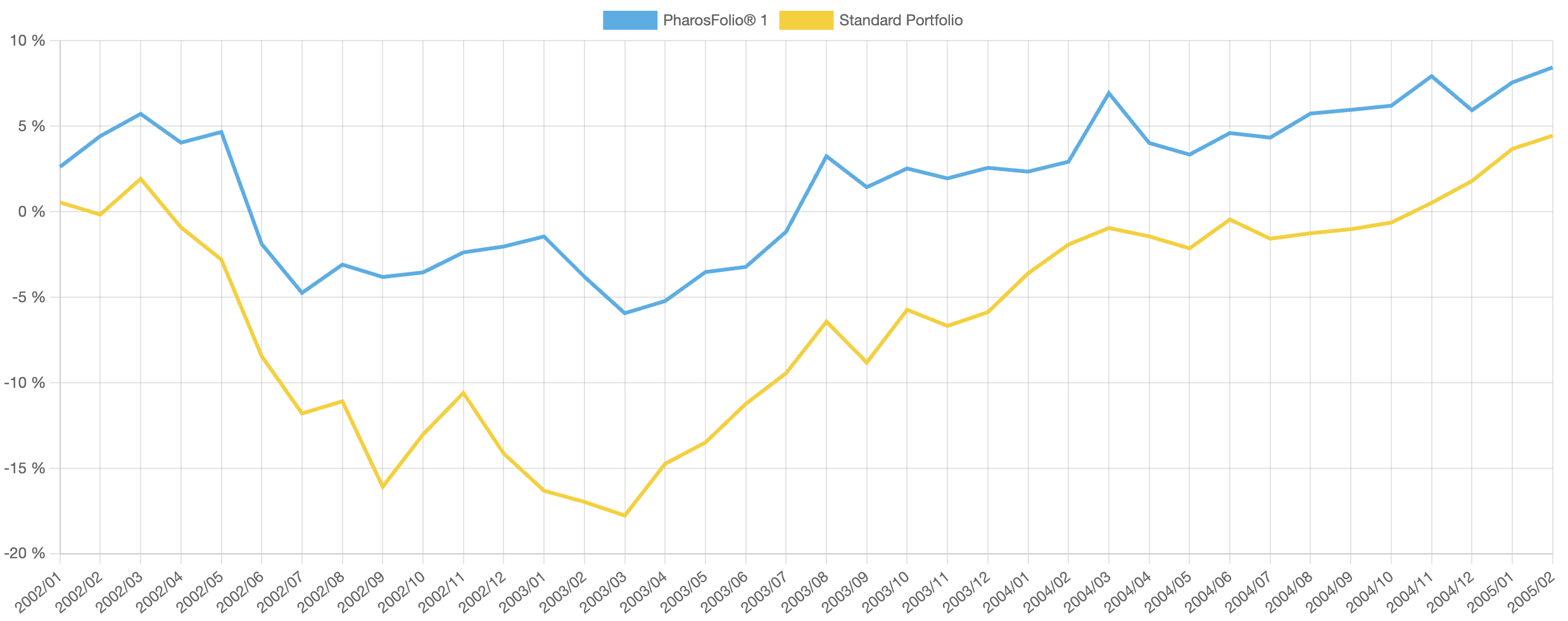

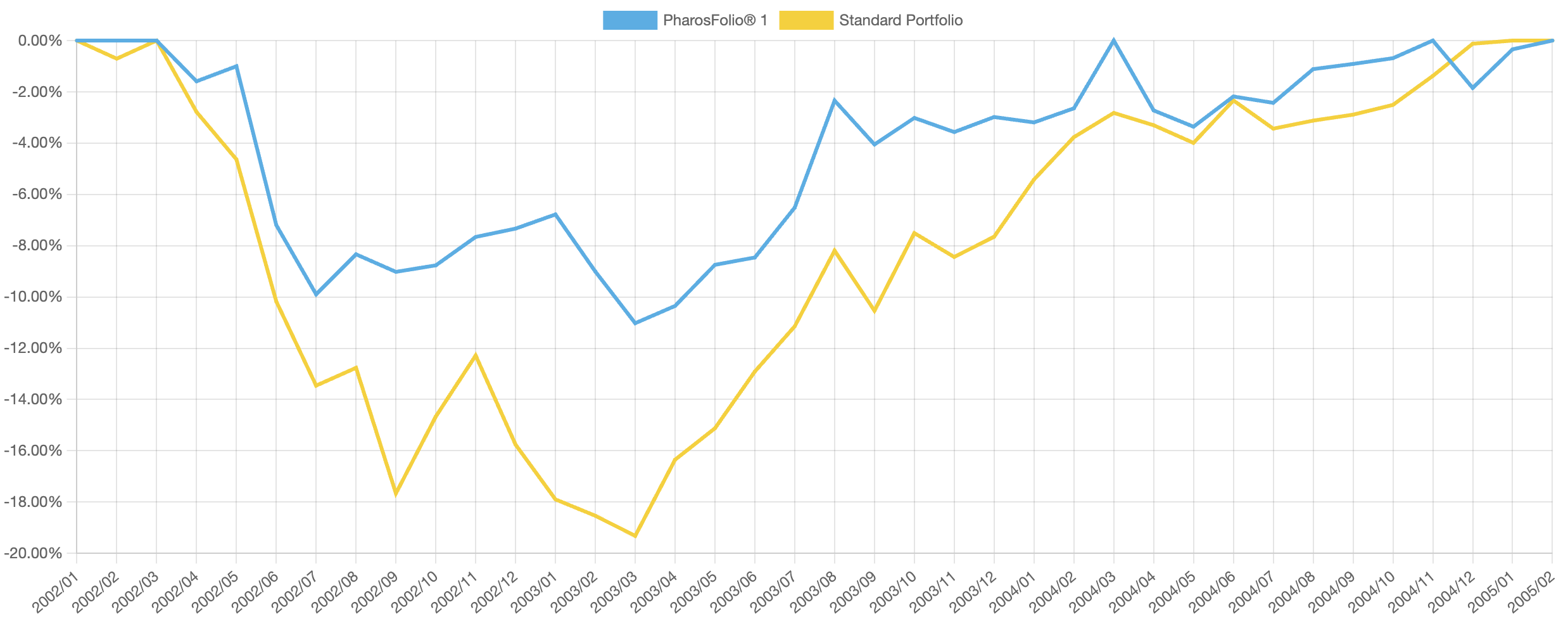

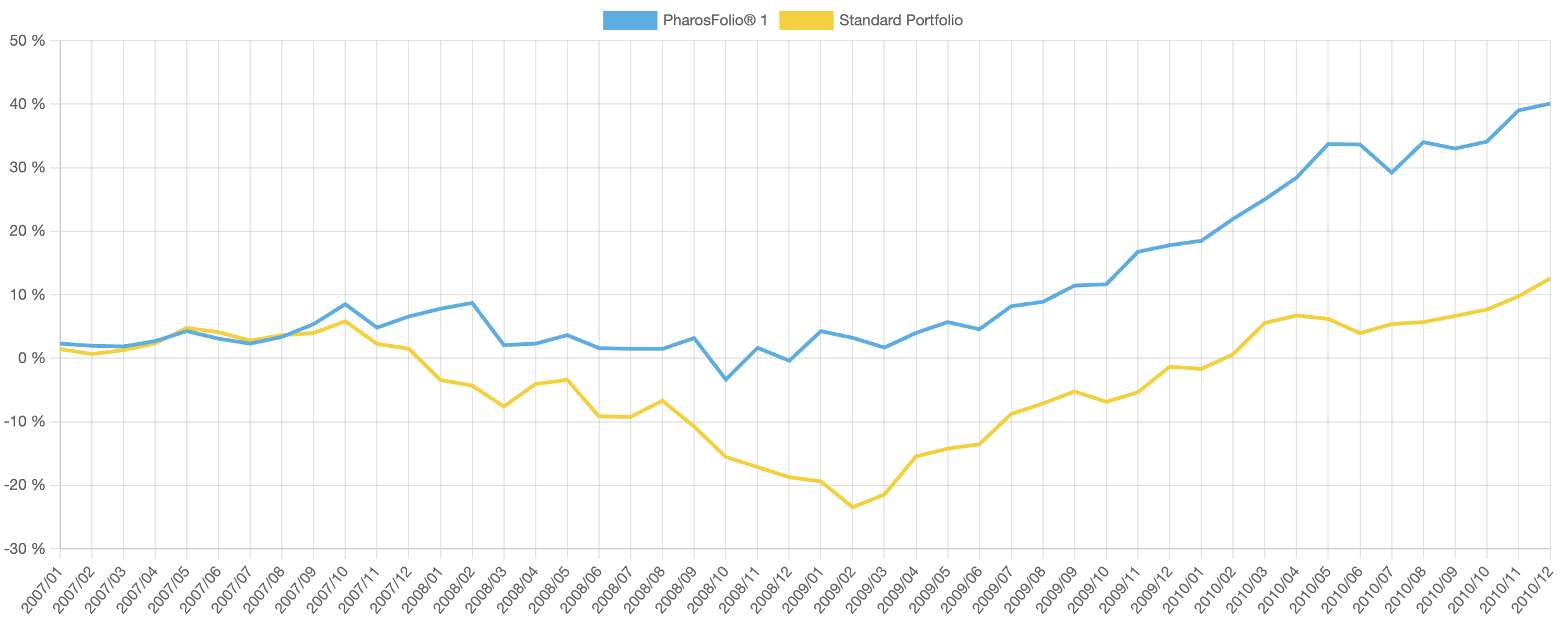

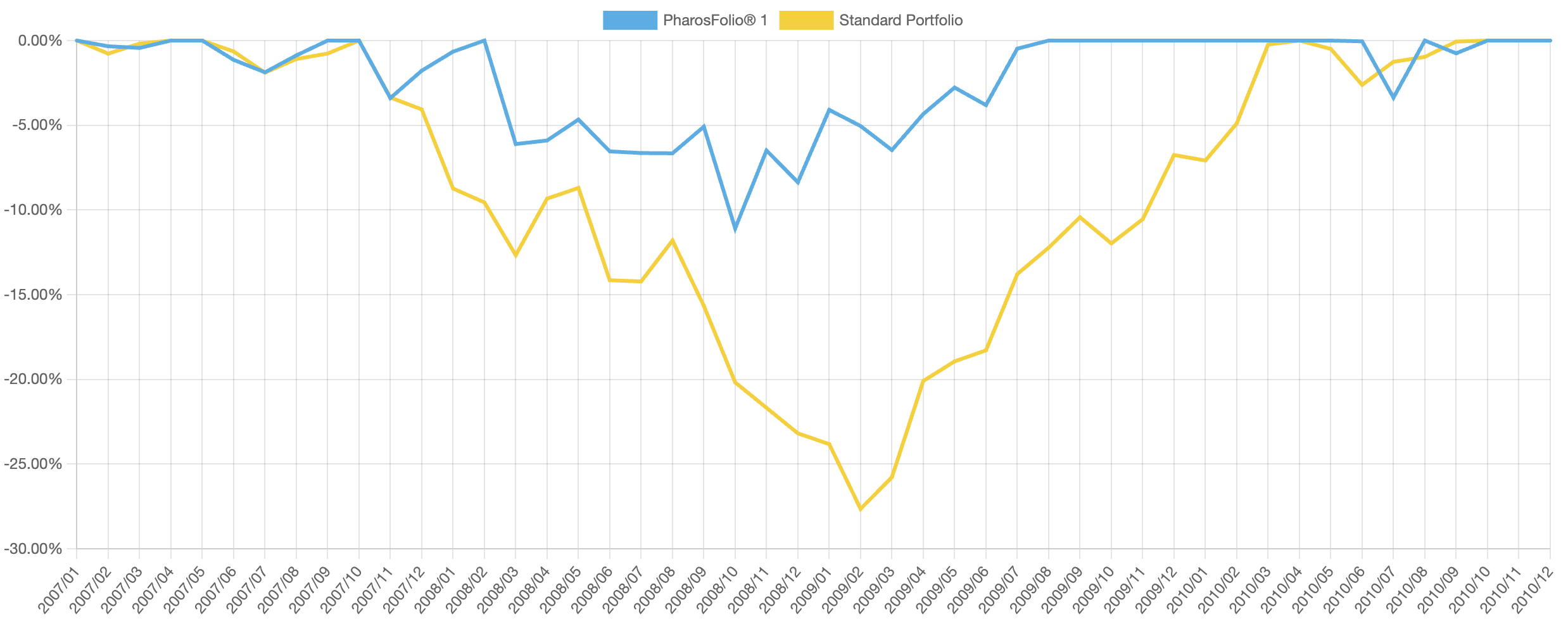

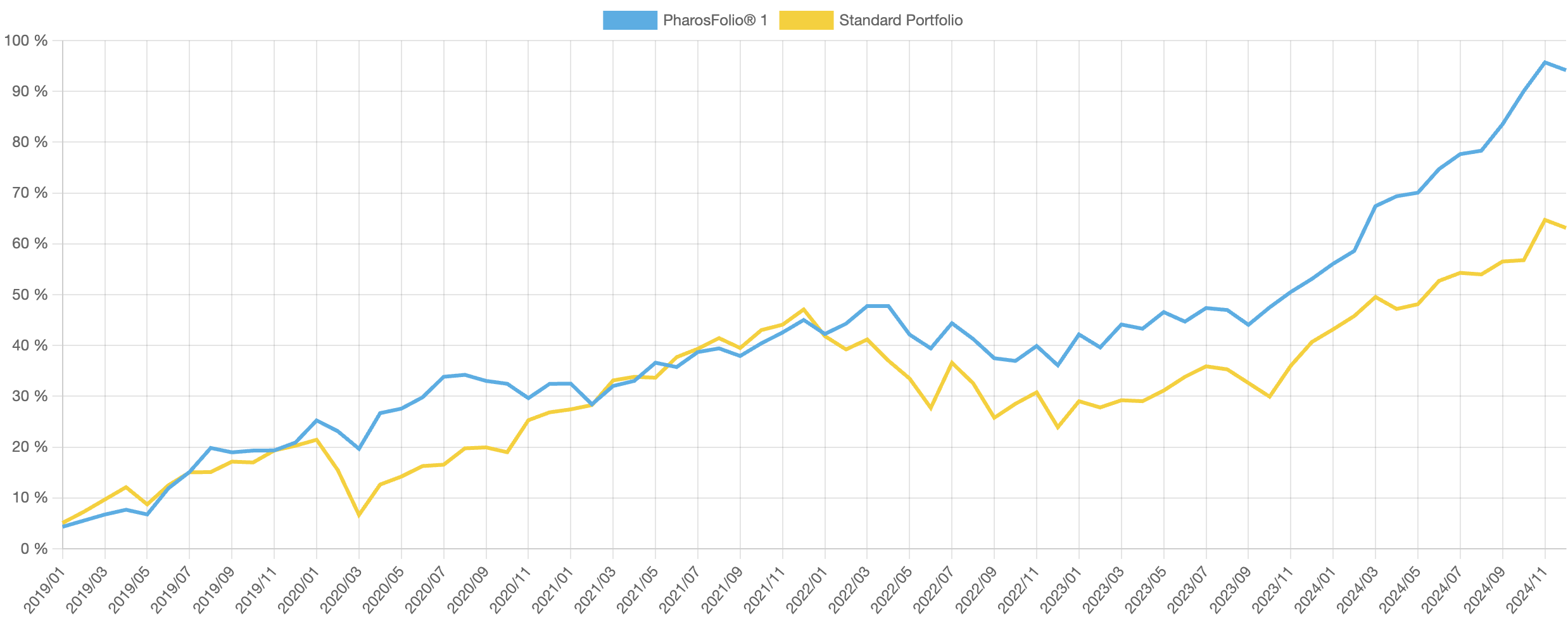

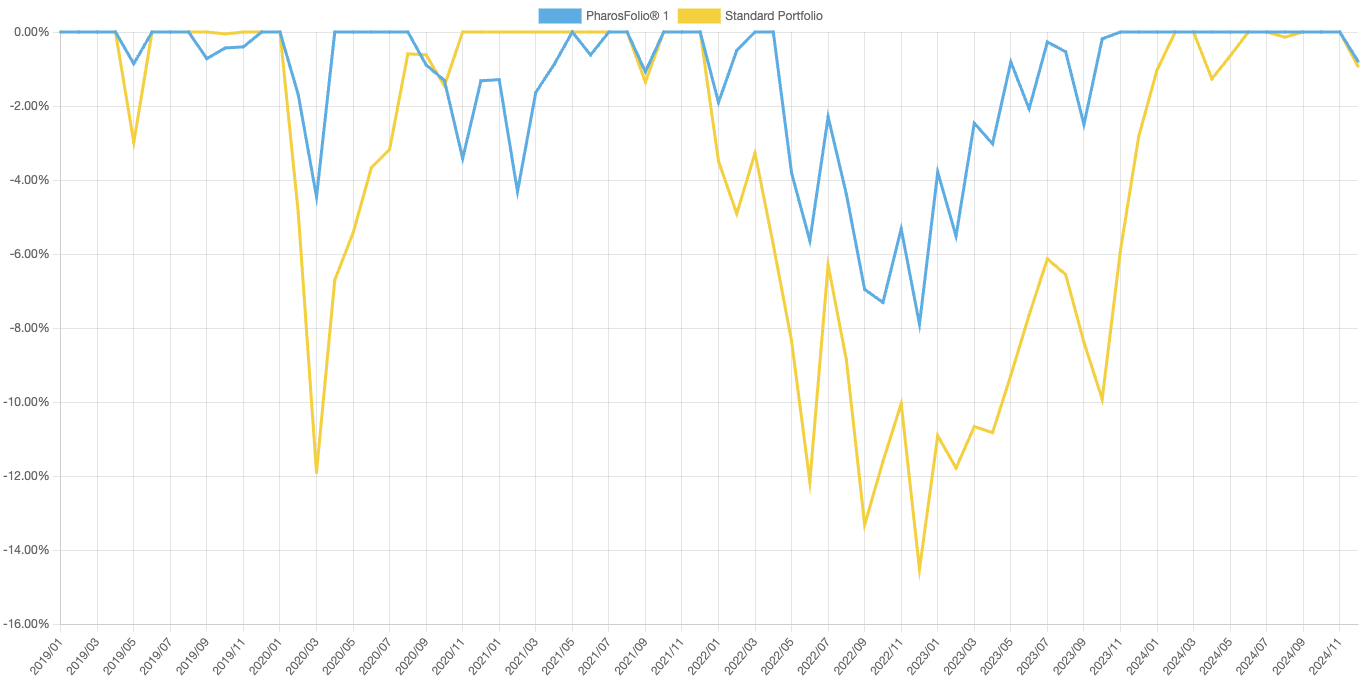

PharosFolio® is a portfolio simulator that helps you explore the behaviour over time of a single, risk-optimized investment model built on just three core asset classes: stocks, bonds, and gold. You choose your preferred risk level, and the simulator does the rest. Simple, guided, and powerful.